TAXES WHEN BUYING A PROPERTY IN CYPRUS

In this post you will find out how much tax you will pay when buying a property (new or resale) in Cyprus.

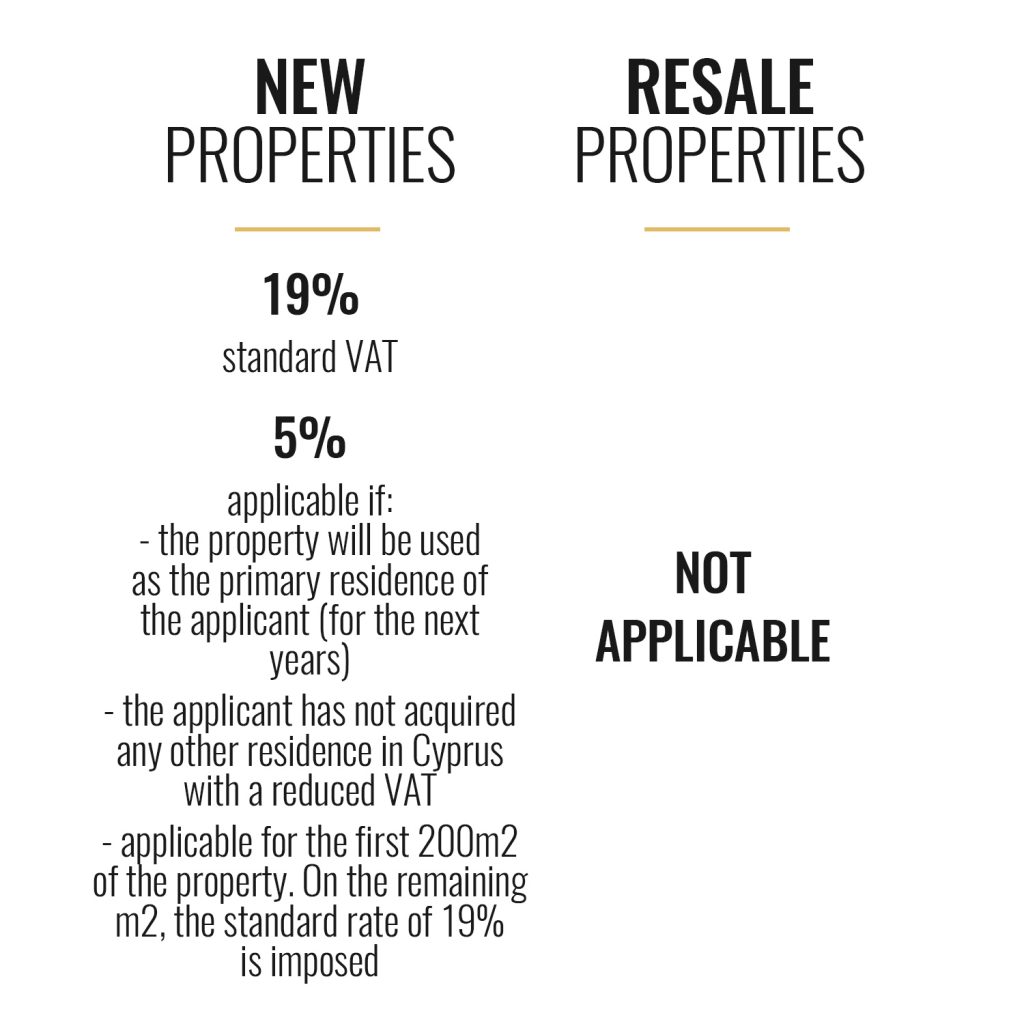

VAT (Value Added Tax)

TRANSFER FEES

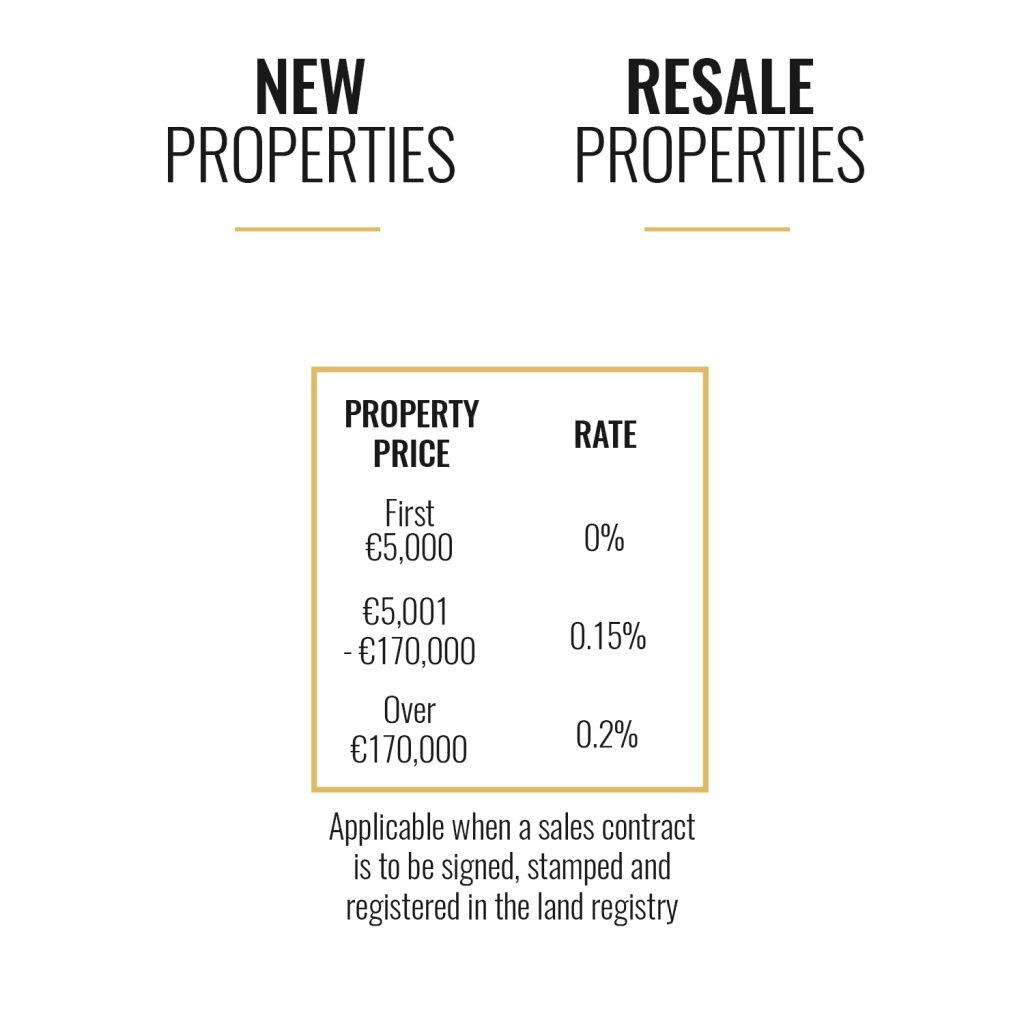

STAMP DUTIES

EXAMPLE 1

Buyer chooses to buy a new 2 bedroom apartment for 170,000 Euros + VAT. The buyer is a foreigner and this is the first time he buys a new property in Cyprus and he will use the property as his primary and permanent residence.

VAT: €180,000 + 5% VAT = €189,000

Transfer Fees: Not applicable

Stamp Duties: (0% x €5,000) + (0.15% x (€170,000 – €5,001)) + (0.2% x (€180,000 – €170,001)) = €267.50

TOTAL TO BE PAID = €189,267.50

You can check our projects here:

“Infinity Residence” : http://www.infinityproperties.com.cy/infinity1/

“City Home Residence” : http://www.infinityproperties.com.cy/city-home-residence/

EXAMPLE 2

Buyer chooses to buy a resale 2 bedroom apartment for 170,000 Euros.

VAT: Not applicable

Transfer Fees: 50% x [ (3% x €85,000) + (5% x (€170,000 – €85,001)) + (8% x (€180,000 – €170,001)) ]= €3,800

Stamp Duties: (0% x €5,000) + (0.15% x (€170,000 – €5,001)) + (0.2% x (€180,000 – €170,001)) = €267.50

TOTAL TO BE PAID = €184,267.50